Spend with certainty: Exclusive Funds Creditors in San Francisco

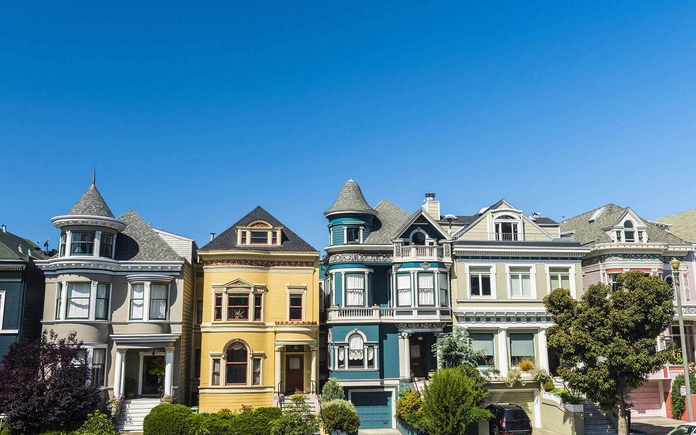

Starting up a whole new organization or going after your own desire often demands significant economic purchase. Real Estate san francisco Conventional loan providers might have prohibitive needs making it difficult to have the necessary funding. But were you aware that you can find exclusive financing remedies obtainable in San Francisco? In this post, we shall investigate the advantages of personal financing and just how it may help account your perspective.

Individual loaning is an alternative to classic credit that offers increased flexibility and more quickly entry to money. Private creditors are folks or organizations that provide financial loans in accordance with the security you can supply or perhaps your creditworthiness. Oftentimes, exclusive loan companies provides cash much faster than banking institutions as well as other conventional creditors. This can be crucial for small businesses proprietors who require funding to keep their surgical procedures proceeding or focus on new possibilities.

Among the main benefits associated with exclusive lending is that it lets you safe financing minus the strict specifications that traditional creditors enforce. Exclusive loan companies often times have a lot less strict specifications in terms of credit rating, security, and income. Which means that you can obtain funding even if you have got a a lot less-than-best credit rating or limited guarantee.

San Francisco delivers a multitude of individual lending alternatives, including difficult dollars lending options, connection lending options, and peer-to-peer loaning alternatives. Tough cash personal loans are normally utilized for property assets and need the consumer to offer you property as equity. Fill personal loans are quick-expression financial loans which provide funding until a much more long-lasting financing source gets to be offered. Peer-to-peer loaning entails borrowing using their company individuals as an alternative to banking institutions or other lending institutions.

When considering private lending alternatives, it is recommended to shop around and evaluate numerous options. Every single loaning option would be unique, and you need to choose one who aligns together with your certain fiscal needs and goals. It is additionally important to browse the fine print associated with a lending deal before you sign so that you will know about each of the conditions and terms.

In a nutshell:

Money your perspective with individual lending remedies is an excellent option for men and women and organizations in San Francisco. By utilizing private lending, you can aquire more quickly entry to money and protect loans despite having significantly less-than-excellent credit rating or constrained equity. San Francisco provides several personal lending choices, each and every with special stipulations. By doing research and assessing numerous lending solutions, you can find financing that aligns along with your desired goals and will help you have the next thing towards chasing your sight.